Price List

Fee Schedule for Free Medical Treatment

We will carefully inform you of the details of the treatment cost and method at the consultation after the examination.

All-ceramic crowns

Ceramic baked onto a zirconia frame

- 1 piece176,000 yen

Metal ceramic crown

Ceramic baked on metal frame

- 1 piece176,000 yen

Full Zirconia Crown

Crowns made entirely of zirconia (applicable to molars)

- 1 piece143,000 yen

Laminate veneers

Veneer-like ceramic bonded to the tooth surface

- 1 tooth176,000 yen

Ceramic inlay

Ceramic inlay

- 88,000 yen

Ceramic anlay

Partial ceramic headpiece

- 121,000 yen

Fiber core (tooth foundation)

Measures to reinforce teeth with fiber

- 1 tooth25,400 yen

Whitening

Office whitening (60 min. x 3 times) + Home whitening

- 66,000 yen

Dentures

Full dentures (treatment dentures + adjustment fee not included)

(*Depends on the material used.

- One jaw385,000 yen and up

Dentures

Partial dentures

(Treatment denture + adjustment fee not included)

- One denture440,000 yen and up

Overdenture

Full dentures placed over natural teeth or implants

(metal frame + laboratory fee included, attachments not included)

- One jaw550,000 yen and up

Implant

Cost for one set of dental implants from implant placement to ceramic tooth set

- One implant550,000 yen~

Chairside Provisional Restoration

Temporary teeth made on site. The director himself fabricates them under a microscope.

- At the time of creation: 1 tooth5,500 yen

- Adjustment feeFrom 4,400 yen

Complete orthodontic examination

CT, Cephalo, Scan, Facial profile photograph

*Simulation and consultation included

- Basic fee44,000 yen

- + Model+ 5,500 yen

- + Cadiacs (jaw movement measurement)+ 11,000 yen

Full Jaw Correction

- Wire1,045,000 yen

- Mouthpiece1,045,000 yen

- Hybrid1,045,000yen

Single Jaw Correction

- 550,000 yen

Localized orthodontics

- Depends on the situation220,000 - 440,000 yen

- Adjustment fee6,600 yen

Restorative system (MTA)

- Depends on the amount used33,000 yen

Provisional (chairside)

- 1 tooth5,500 yen

- Adjustment fee4,400 yen

Provisional (lab-side)

- Natural tooth: 113,200 yen

- Implant: 1 tooth33,000 yen

- Adjustment fee4,400 yen

Precision impression

- 1 block6,600 yen

Treatment fee for special treatment

Immediate implant placement after tooth extraction + bone building procedure

Surgery to place an implant is performed at the same time as tooth extraction, followed by osteogenesis.

By combining all surgeries at once, the treatment period can be shortened.

*Since the size of the replacement material and artificial membrane varies depending on the extent of the defect, the time may vary.

- 1 block132,000 yen

Socket preservation

Surgery to minimize bone resorption after tooth extraction

- 1 tooth55,000 yen~

Gingival grafting

Surgery to fill in the hollow of a missing tooth by grafting gum

- 1 toothFrom 55,000 yen

Root surface covering

Surgery to restore the root surface where the gingiva has receded

- Normal caseFrom 55,000 yen

- Complicated casesFrom 88,000 yen

Periodontal tissue regeneration therapy

Surgery to regenerate bone in a defect (per block)

- Normal cases77,000 yen and up

- Complicated casesFrom 110,000 yen

Orthodontic tooth extraction (extrusion)

A procedure in which a rubber band is applied to the teeth to extend the healthy tooth structure above the gingiva.

- 1 toothFrom 55,000 yen

Payment Methods for Unreserved Treatment Fees

The number of times of payment for free treatment is decided by consultation between the doctor in charge and the patient.

We accept payment over the counter, by bank transfer, or by credit card.

- Bank transfer fees are the responsibility of the patient.

Examples of payments

- One payment (at the beginning of treatment)

- Three payments (at the beginning of treatment, in the middle of treatment, and at the end of treatment)

- Monthly installment payments (please consult with us about bonus payments and number of installments)

We also accept the following credit cards for payment of self-funded treatment fees.

![]()

Health insurance is not accepted for free treatment such as implants, but high-cost treatment expenses are subject to a medical expense deduction.

Medical Expense Deduction

What is the medical expense deduction for dentistry?

The medical expense deduction is a system that allows you to receive a certain amount of income tax credit for medical expenses paid for you and your family.

Expenses incurred for medical treatment are subject to the medical expense deduction. The medical expense deduction is a system established to reduce the burden of medical expenses, and a portion of your income tax will be refunded if you need to pay 100,000 yen or more for medical expenses in a year.

If you paid medical expenses for yourself and your spouse or other relatives with whom you share a living arrangement (for the period from January 1 to December 31 of each year), you are eligible for the medical expense deduction if you file a tax return by March 15 of the following year, and your taxes will be refunded or reduced.

However, medical expenses paid during the year must be 100,000 yen or more to be eligible (the amount declared is limited to 2 million yen). Those whose total income is up to 2,000,000 yen can file a tax return if medical expenses account for 5% or more of their income.

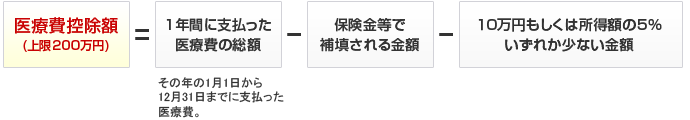

Amount of Deduction

The amount of deduction is calculated as follows

The higher the income, the higher the tax rate, so the higher the income, the higher the refund.

Medical Expenses Eligible for the Medical Expense Deduction

- Medical and treatment expenses paid to doctors and dentists

- Expenses for purchasing medical supplies for treatment

- Transportation expenses (train fare, bus fare, cab fare, etc.) normally required for hospital visits and hospitalization

- Expenses for treatment by anma, massage, shiatsu, acupuncture, and moxibustion therapists

- Others

What you need to get a tax refund

- Final (refund) tax return (Certificate of withholding tax for salaried workers)

- Receipts (photocopies are not acceptable)

- Personal seal, bankbook

- The final tax return (refund) form is available at your local tax office.

- The filing period is between February 16 and March 15 of the following year. However, tax refunds for salaried workers are accepted after January.